More About Luxury Home Appliances

Wiki Article

The 15-Second Trick For Luxury Home Appliances

Table of ContentsEverything about Luxury Home AppliancesHow Luxury Home Appliances can Save You Time, Stress, and Money.9 Simple Techniques For Luxury Home AppliancesThe Basic Principles Of Luxury Home Appliances

Residence insurance policy may likewise cover medical expenditures for injuries that individuals endured by getting on your residential or commercial property. A homeowner pays an annual premium to their house owner's insurer. On standard, this is someplace between $300-$1,000 a year, relying on the plan. When something is harmed by a calamity that is covered under the house insurance plan, a home owner will call their home insurance policy company to file an insurance claim.Homeowners will generally need to pay an insurance deductible, a fixed quantity of cash that comes out of the house owner's wallet prior to the residence insurer pays any type of cash in the direction of the insurance claim (luxury home appliances). A residence insurance policy deductible can be anywhere in between $100 to $2,000. Generally, the greater the deductible, the reduced the annual premium price.

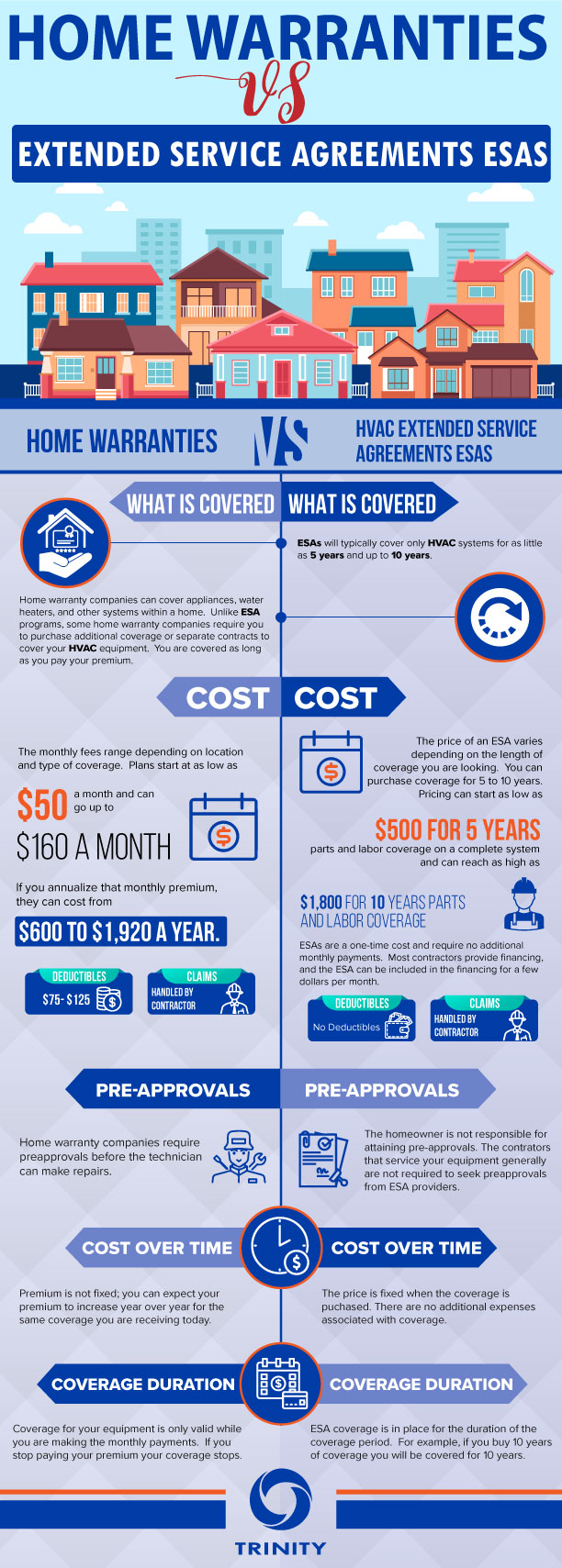

What is the Distinction Between Residence Warranty and House Insurance A residence guarantee agreement as well as a residence insurance plan operate in comparable ways. Both have a yearly costs and also a deductible, although a home insurance premium and also deductible is commonly a lot higher than a residence service warranty's. The main differences in between home guarantees and also residence insurance are what they cover.

How Luxury Home Appliances can Save You Time, Stress, and Money.

If there is damage done to the structure of your house, the owner will not need to pay the high expenses to repair it if they have residence insurance. If the damage to the house's framework or property owner's belongings was produced by a malfunctioning devices or systems, a home service warranty can help to cover the expensive repairs or replacement if the system or appliance has stopped working from regular wear and tear. luxury home appliances.They will collaborate to supply security on every part of your house. If you have an interest in purchasing a house guarantee for your house, take a look at Landmark's house guarantee strategies and rates here, or demand a quote for your house below.

In a warm seller's market where residence buyers are forgoing the residence inspection contingency, purchasing a house service warranty might be a balm for stress over possible unknowns. To get the most out of a house service warranty, it is essential to read the small print so you comprehend what's covered and exactly how the strategy functions prior to registering.

The difference is that a house warranty covers an array of things instead of just one. There are three standard kinds of residence warranty strategies. System prepares important source cover your home's mechanical systems, including heating & cooling, electric as well as pipes. Appliance plans cover major appliances, like the dishwasher, stove and cleaning machine.

Getting My Luxury Home Appliances To Work

Building contractor service warranties normally do not cover home appliances, though in an all new house with all new devices, producers' service warranties are most likely still in play. If you're getting a residence service warranty for a new house either new building and construction or a house that's new to you insurance coverage usually begins when you close.

In other words, if you're acquiring a house and a concern shows up during the residence evaluation or is kept in mind in the vendor's disclosures, your residence blog here warranty firm might not cover it. Instead of counting only on a service warranty, attempt to bargain with the vendor to either treat the issue or offer you a credit scores to assist cover the cost of having it repaired.

You don't need to study as well as get referrals to find a tradesperson each time you require something dealt with. The flip side of that is that you'll obtain whomever the residence guarantee company sends to do the assessment and make the repair. You can not select a professional (or do the work yourself) as well as after that obtain compensated.

An Unbiased View of Luxury Home Appliances

For one, house owners insurance is required my latest blog post by loan providers in order to obtain a mortgage, while a house service warranty is completely optional. As mentioned above, a residence guarantee covers the repair as well as substitute of things as well as systems in your house.Your property owners insurance, on the other hand, covers the unforeseen. It won't assist you replace your home appliances because they obtained old, however property owners insurance policy can help you obtain brand-new home appliances if your existing ones are harmed in a fire or flood.

Just how much does a residence service warranty cost? Residence guarantees usually set you back in between $300 and $600 per year; the expense will vary depending on the kind of strategy you have.

Report this wiki page